Customer knowledge

As per wikipedia Customer knowledge (CK) is the combination of experience, value and insight information which is needed, created and absorbed during the transaction and exchange between the customers and enterprise. Campbell (2003) defines customer knowledge as: “organized and structured information about the customer as a result of systematic processing”. According to Mitussis et al. (2006), customer knowledge is identified as one of the more complex types of knowledge, since customer knowledge can be captured from different sources and channels. (source: wikipedia)

Based on our research, Customer Knowledge is the second best competitive advantage for any company. First is Culture! . On an average, brands are spending 40% of their budget to manage Customer insights (part of customer experience ). However, few have partial or no idea where to spend the money mindfully. This is classic dilemma in small and medium businesses in India. The budget is not allocated well and there are over laps. These two point us to lack of understanding of the Importance of Customer Knowledge Management. Another problem is most of the data get wasted in the channels and distribution points. No one is capturing. No dedicated department to do the hard work. However, we are not discussing this under this topic…

———

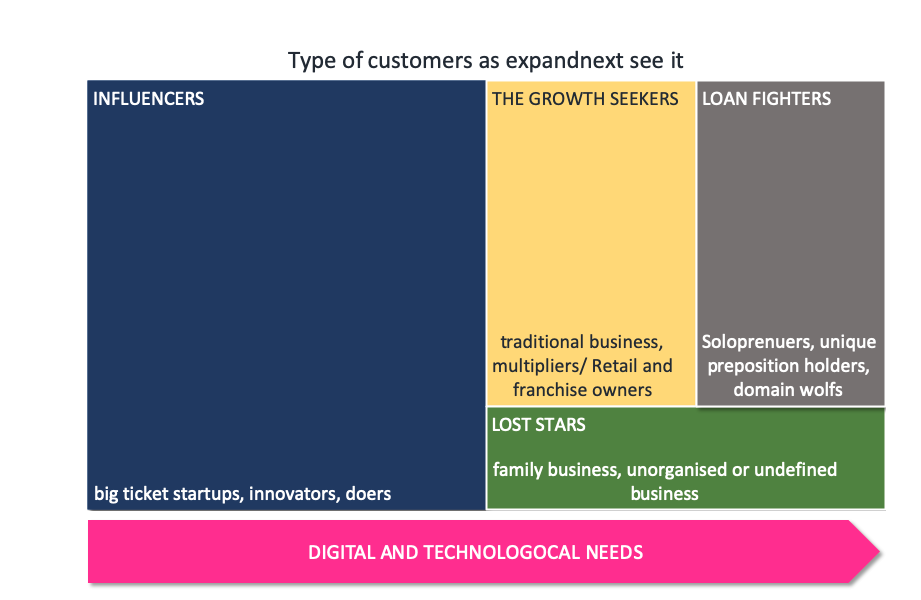

In any market situation, customers segmentation cannot go undefined. It makes no sense to offer product and service without clear understanding of customers. The way brands define customers, they define the problem and solve them efficiently. With the collective knowledge in small and medium businesses (in the COVID-19 era), expandnext reimagined customer into 4 main categories –

INFLUENCERS – big ticket startups, innovators, doers – they don’t need business consulting full service, they look for partners in crimes, outsource is best policy, agile buddies. They are problem solvers

The growth seekers – traditional business, multipliers/ Retail and franchise owners – look for specialised advisory services, don’t have deep idea of consulting, deep pocket but conservative

Lost stars – family business, unorganised or undefined business – they look for turnaround ideas, budget pockets, Often cynical and twice cautious before spending a dollar!

Lone fighters – Soloprenuers, unique preposition holders, domain wolfs – undefined ! They go either direction once they understand the advantage of advisory services. Difficult.

Note –

The digital and Technological needs are across the categories/ types of customers.

The categories of customers are mutually inclusive. They could overlap at some point of the growth stage and at the same time could move to other categories in case they lag behind or fail to perform due to internal mis-management ( example – influencer could fall into Lost stars due to several wrong decisions/ policy paralysis).

——- JUST A LITTLE DE-TOUR BELOW—–

The consulting value chain:

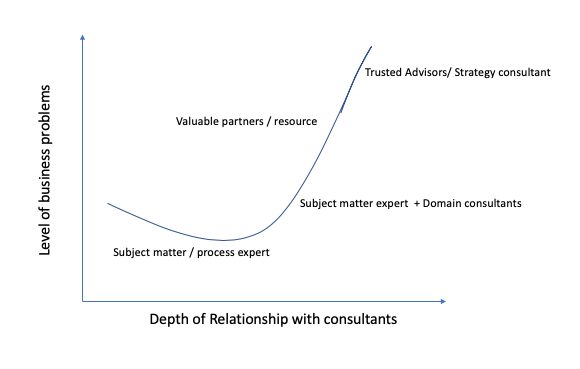

Based on our experiences with these 4 types of customers, broadly – the engagement with consultant or consulting firm depends on the Level of business problems and Depth of relationships business (customers) wants to establish with constant / consulting agency.

Why bring Consulting Value chain in between (customer knowledge) ?

Customer Knowledge requires lot of digging, chasing, capturing, maintaining and finally drawing insights. Insights are highlighted by Consultant – internal team or an external agency or independent advisors. Companies must understand the Value Chain. Each level of Problems requires deep analysis of data which the converted into Insights. Insights are Customer knowledge a brand must have to pitch the next service or product. It is as basic as the simplified graphical representation above. Either companies hire consultants / insights team or outsource the insight processing to external consultants, advisory agencies must take initiative to understand its customer they are planning to sell or engage with. Independent Consultants or advisory agencies should understand their market positioning and help companies / customers understand the Consulting Value chain for successful engagement.

Similarly, the level of business problems ( Y-axis) also differs with 4 Customer Types. Big ticket customer (Influencers) would go for Trusted advisor. They hire full or part time Consultant /Subject Matter experts. However, the COVID-19 has accelerated the demand of Flexi independent consultants. As per Flexing It, there is a significant growth in demand in Q2 , with companies increasingly leveraging consultants as they opt to keep costs variable while accessing top-tier expertise. Key shift in the professional gig economy in different sectors on the impact of COVID-19.

Customer Knowledge – competitive advantage

Once the customer are categorised, companies need to decide the segmentation strategy. This process will ensure competitive advantage by following action items in place –

- Set customer segmentation goals (Note: this is not one-size-fit-all thing/ it keeps changing as per problem you are solving)

- Custom segment the customers (group it as per your choice)

- Target and reach your customer segments

- Analyze your customer segments ( you can customise / adjust as required)

The above 4 steps based one your Customer Knowledge is your competitive advantage over others in any market segment. Eventually once you put the above steps into process / as a repeat behaviour action. It will become part of the company culture!

Thank you for reading

#expandnext